What is Jim Chanos' Net Worth?

Jim Chanos, an American hedge fund manager, has an impressive net worth of $400 million. As the founder of Chanos & Co and Kynikos Associates, he has gained global acclaim as a short-seller with a keen understanding of companies' fundamentals. His strategic acumen and incisive analysis have made him one of the industry's most respected investment managers.

Chanos first gained significant fame and fortune in the 2000s by short selling Enron, a position initially seen as risky and contrarian. His accurate prediction led to a highly profitable outcome. Since then, he has taken notable short positions against companies such as Tesla and Beyond Meat.

At its peak, Kynikos Associates managed $6 billion, making Chanos a multi-billionaire. However, by 2018, the firm's assets had decreased to $2 billion, and by 2020, the assets were reportedly less than $500 million.

Early Life

Jim Chanos was born in Milwaukee, Wisconsin, on December 24, 1957. His father owned a chain of successful dry-cleaning businesses, which sparked Chanos' interest in business. He earned his bachelor’s degree in economics and political science from Yale University in 1980. While at Yale, he gained initial investment industry experience through a part-time job at brokerage firm Gilford Securities.

Early Career

After graduating, Chanos moved to Chicago and began his career as an analyst at Blyth Eastman Paine Webber. He quickly rose to prominence during the Baldwin-United Corporation scandal. His suspicions were triggered by Baldwin's acquisition of MGIC Investment Corp. Upon investigation, he discovered that Baldwin was using its insurance subsidiaries to finance its parent company, an inherently risky practice that led to Baldwin-United's bankruptcy in 1983, thus establishing his reputation in the investment world.

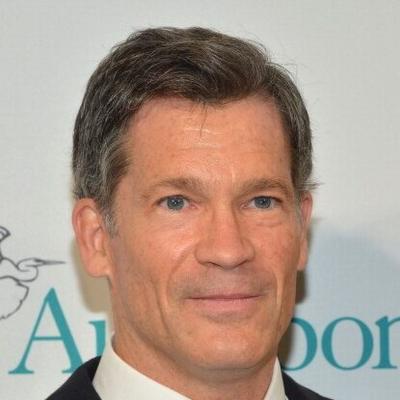

Andy Kropa/Getty Images

Founding of Kynikos Associates

In 1985, Chanos founded Kynikos Associates, named after the Greek word for cynic, meaning 'dog-like' or 'questioning.' The New York City-based investment firm specializes in short-selling, betting on the decline of stock prices. Chanos’s investment style involves detailed research and forensic accounting to identify overvalued stocks and potential corporate fraud.

The Enron Short and Global Recognition

Jim Chanos’s most famous investment came with his short position on Enron in the early 2000s. He realized that the energy company's financial statements were flawed and began shorting its stock long before its 2001 collapse. Chanos's critical role in uncovering the Enron scandal further solidified his reputation as a top short-seller in the finance world.

Chanos's firm reportedly earned $500 million from the Enron short.

Present Day Influence and Advocacy

Today, Jim Chanos remains a significant figure in financial markets, often appearing in the media to share his insights. He is an active participant in public policy discussions and a strong advocate for financial market transparency. As a guest lecturer at Yale University's School of Management, he continues to impart his knowledge to future finance professionals.

Real Estate

Jim Chanos has recently divided his time between New York City and Miami.

In 2008, he purchased a penthouse apartment in Manhattan for $20 million. He listed the property for $34 million in 2019 but did not find a buyer. In May 2023, he re-listed it for $23.5 million.

In February 2021, Jim sold his East Hampton oceanfront home for $60 million.

In 2003, he bought an apartment in a luxury Miami building for $3.11 million. He later acquired a lower unit for staff. In May 2023, he listed the primary condo for $21 million and the staff apartment for $4 million.