What was Andrew Carnegie's net worth?

Andrew Carnegie was a Scottish-American industrialist who led the expansion of the American steel industry in the late 19th century. During his lifetime, Andrew Carnegie had a peak, inflation-adjusted, net worth of $310 billion, making him the 4th richest human being of all time. Carnegie is renowned as one of the most generous philanthropists, donating over 90% of his fortune to various foundations, charities, and organizations before his death.

Carnegie revolutionized the steel industry by mass-producing steel and implementing vertical integration. He controlled the most extensive integrated iron and steel operations in the U.S. at the time. His significant innovation was adopting and adapting the Bessemer process, which allowed for cheap and efficient steel production.

In 1909, Carnegie sold the Pittsburgh-based Carnegie Steel Company to J.P. Morgan for $303 million. His share of the sale amounted to $225 million, or roughly $7 billion in today's dollars. The final amount eventually grew to $480 million due to interest on the bonds used for the transaction. Adjusted to today’s economy, his personal fortune would be equivalent to hundreds of billions of dollars. Most estimates peg his current-day net worth at $300-$310 billion.

The renamed U.S. Steel Corporation later became the first company in U.S. history to have a market capitalization exceeding $1 billion. After selling his business, Carnegie devoted his life to philanthropy, focusing on local libraries, world peace, education, and scientific research.

By the time of his death, he had given away more than $350 million. His remaining $30 million was donated to foundations, charities, and pensioners.

Early Life

Carnegie was born on November 25th, 1835, in Dunfermline, Scotland, to parents Margaret and William Carnegie. His upbringing was modest, with the family sharing a two-room cottage. Due to financial struggles, the family borrowed money and moved to Allegheny, Pennsylvania, in 1848.

In the U.S., Carnegie began his career as a bobbin boy in a cotton mill, later becoming a telegraph messenger boy. His transition to the Pennsylvania Railroad Company at 18 was pivotal, as he became the superintendent of the Western Division, establishing valuable connections with future investors and honing his management skills.

His business acumen led to his first $10 dividend check at 21. Reflecting on this, Carnegie said, "It gave me the first penny of revenue from capital – something I had not worked for with the sweat of my brow. Eureka! Here's the goose that lays the Golden eggs!"

By the age of 40, dividend checks and interest payments on bonds secured his status as a millionaire.

Professional Pursuits

During the Civil War, Carnegie's work for the Pennsylvania Railroad granted him a draft deferment. His role was essential for the Northern army's supply lines. After the war, Carnegie continued as a manager and investor, arranging successful mergers and securing lucrative partnerships.

Carnegie's pre-steel success lay in owning businesses interlinked with related industries. By the early 1870s, Carnegie held significant interests in Union Iron Mills, Keystone Bridge Company, and other ventures, leading to influential business practices.

His strategic moves included founding the Keystone Telegraph Company and merging it with other firms for substantial profits. He held onto shares of Western Union, resulting in lucrative annual dividends.

His main business interests in the 1870s included:

- 40% of Union Iron Mills

- 20% of Keystone Bridge Company

- 40% of a furnace company named Lucy

- Holdings in several railroad companies, notably the Pennsylvania Railroad

Spending significant time in Europe selling bonds and dealing with supply shortages, Carnegie built a robust industrial empire.

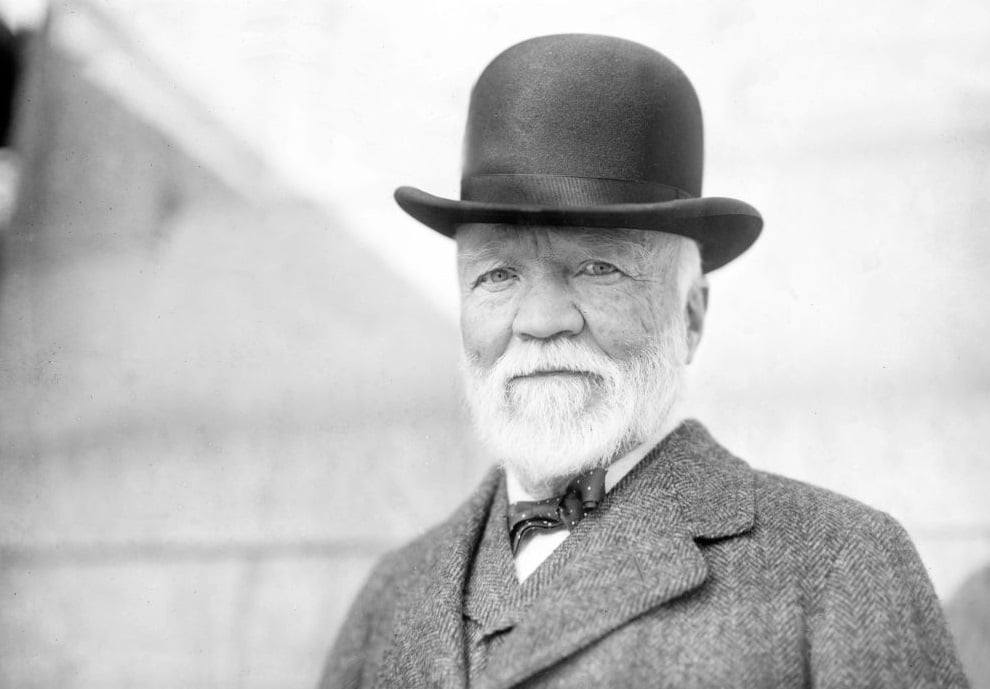

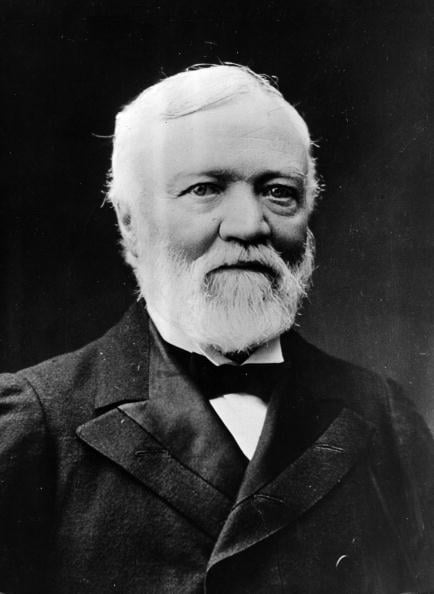

(Photo by APIC/Getty Images)

Steel

Carnegie's focus shifted to ironworks and steel, industries where his decisions significantly impacted growth. Adopting the Bessemer process and vertically integrating production led to Carnegie Steel Company's formation.

Sale to J.P Morgan

As retirement approached, Carnegie Steel executive Charles M. Schwab began negotiations to sell the company to financier J.P. Morgan. The sale was finalized for $303 million, of which Carnegie's share was $225 million. The company's payment in bonds led to an eventual total of $480 million, including interest.

One of Carnegie's first acts post-sale was to allocate $5 million to fully fund his steel workers' pension.

Philanthropic and Scholarly Pursuits

Carnegie balanced his business career with philanthropy and writing. He funded the Dunfermline Carnegie Library in Scotland and numerous educational institutions, including the Carnegie Laboratory at NYU. He authored influential books and articles, with "Triumphant Democracy" and "Wealth" being notable works.

Upon retirement, he became a full-time philanthropist, funding over 3,000 libraries and investing heavily in universities, research centers, and education organizations. His support extended to projects like the 100-inch Hooker telescope and the National Negro Business League.

Getty Images

Carnegie's interest in music led to personal funding for Carnegie Hall and the construction of over 7,000 church organs globally.

Personal Life

At 51, Carnegie married 30-year-old Louise Whitfield. The couple had their only child, Margaret, ten years later. Carnegie died in 1919 of bronchial pneumonia in Massachusetts.

Legacy

Carnegie's legacy lives on through numerous foundations, organizations, universities, and charities he founded or significantly funded. Notable institutions include Carnegie Mellon University, the Carnegie Corporation of New York, and the Carnegie Foundation for the Advancement of Teaching. Many streets, towns, and awards, including the Carnegie Medal, are named in his honor, reflecting his enduring impact.